Ten Things Planners Need to Know About Demographics and the Future Real Estate Market

Professor Arthur C. Nelson, of the University of Utah, has made a career out of studying the relationships between demographic and real estate market trends. He predicted the 2007 collapse of the housing market because of oversupply of key housing types so, when he talks, I listen. And his latest analysis suggests that the growth in demand for new housing over the next 30 years will consist primarily of demand for smaller homes on smaller lots, a reversal of the type of demand that fueled sprawl in the late 20th century.

Much of Nelson's thinking is collected in his data-rich 2013 book, Reshaping Metropolitan America. It is consistent with information I have collected and shared both here and, in more detail, in a chapter of my own new book, People Habitat.

Last week, Nelson made a presentation in Columbus, Ohio, reported in the blog of my colleague, Deron Lovaas. What was especially interesting to me was to see Nelson's analysis projected out not just to 2030, as in his book, but out to 2040. As far as I know, the presentation isn't online, but I have reviewed it carefully. Here are what I believe to be the most important points:

1. The US population will grow by 31 percent between 2010 and 2040. In 2010, our population stood at about 308 million people. By 2040, we will be at about 406 million.

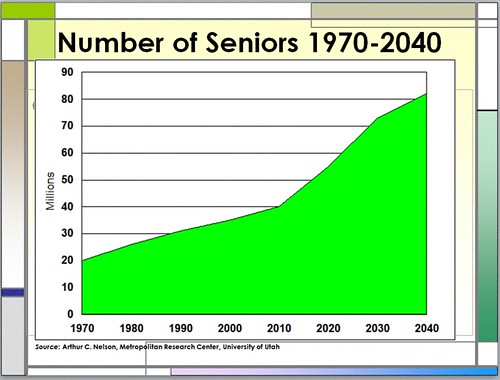

2. More than 40 percent of population growth between 2010 and 2040 will be persons aged 65 and older. On 2010, ages 65 and older claimed 40 million people, or 13 percent of total population. By 2040, the share of seniors will be 81 million, or 20 percent of the total.

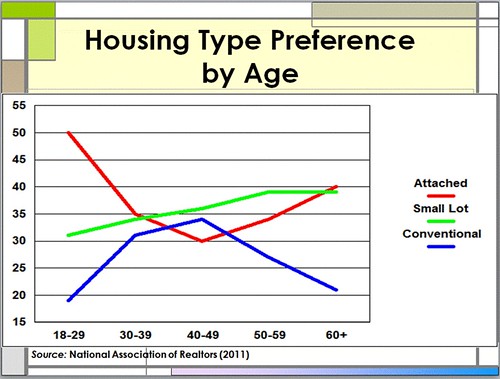

3. The share of household growth claimed by ages 35-64 (the bracket traditionally seeking the most housing space) will almost be halved. From 1990 to 2010, 65 percent of household growth consisted of persons aged 35 to 64. Between 2010 and 2040, only 35 percent of household growth will comprise persons in that age bracket.

4. More than 80 percent of growth in households will be households without children. This makes sense given that the baby boomers, the largest generation in American history, are now empty nesters; people are living longer; and the Millennial generation is, for the most part, not having children yet.

5. More than 40 percent of growth in households will be single-person households.

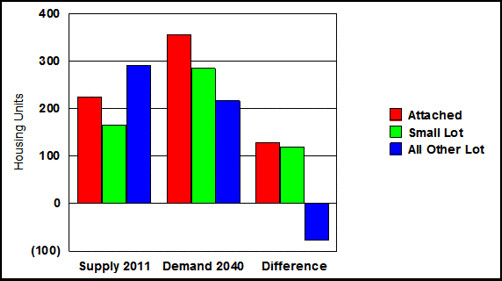

6. Half of all new housing demand will be for attached homes and the other half for small lot homes. This is another reversal from past preferences.

7. Demand for large-lot homes will decline below 2011 levels. At first blush, this statement seems shocking. But, on further consideration, it isn't, given that Nelson isn't saying that demand will dry up. He's basically saying that this isn't the part of the market that will experience growth. Demand for large lots will continue, but it won't be as high as before. This could portend more mortgages under water for those who have invested in large-lot homes.

8. Half of the growth in households will be renters. The home ownership rate has been declining since 2004.

9. The next 30 years will bring demand for over one billion square feet of nonresidential space, or almost twice what exists now. That is a bit scary to contemplate, until one considers Nelson's next point:

10. Seventy percent of new nonresidential space will be redevelopment on existing developed lots. In fact, Nelson says that, if the density of new development were increased (from an average floor-area ratio of 0.2 to 0.5), all new nonresidential and attached residential demand could be met on existing parking lots. That's a pretty amazing statement. (A floor-area ratio of 0.5 means that a one-story building would occupy half its lot; a two-story building would occupy one fourth of its lot; and so on. Large surface parking lots are the biggest cause of low floor-area ratios.)

Redevelopment opportunities arise much more frequently on aging commercial building sites than on residential sites, because of the much shorter average life spans of commercial buildings, especially retail.

For an interesting presentation by Nelson along these lines framed for the state of Utah, go here.

Move your cursor over the images for credit information.