Revealed: LEED-Certified Apartments Earn 9% Higher Rents

In working with the commercial real estate industry on sustainable and energy efficient (SEE) real estate, one of the most frequent inquiries we receive is: why should I pay to certify my property as "green," when I can instead use the funds required for certification to better improve my property? This question can be motivated in a variety of ways.

Some think certification costs too much. Some think it is an unnecessary extra step past making the SEE improvements. Some would just rather use those funds differently, whether that be to improve their financial bottom line or to actually invest in yet more SEE improvements.

We address all of these motivations in our recent paper "Certification Matters: Is Green Talk Cheap Talk?" and we answer that popular question.

At the root of that question lies the importance of signals. Any certification we obtain serves as a signal to the public or the market.

For example, a driver's license is a signal that you are qualified to operate an automobile. This signal might make your friend more likely to lend you their car (or at least the lack of that signal would give your friend pause before handing over their keys).

A university degree is a signal that you have extensive training in a certain field. I could tell you I know a good bit about finance and real estate, but you may be more convinced by my Ph.D. than by my personal assurance that I know what I'm talking about.

For signals to work they must be costly, because if they aren't, everyone would pursue them. Such costs can be in terms of financial commitment, time commitment, or both.

LEED certification is a signal to the market that a property was constructed or is operating in accordance with SEE principles.

A property can certainly pursue such goals without certification. However, it is the third-party confirmation under the LEED program (or other similar programs) that verifies to the market the accordance with SEE principles.

LEED is certainly a costly program, as it requires both funds and time commitment from the property owner.

So the question the market is actually asking is: Is the costly LEED signal worthwhile?

Our research provides the first look at the complete universe of LEED-certified apartment units in the United States.

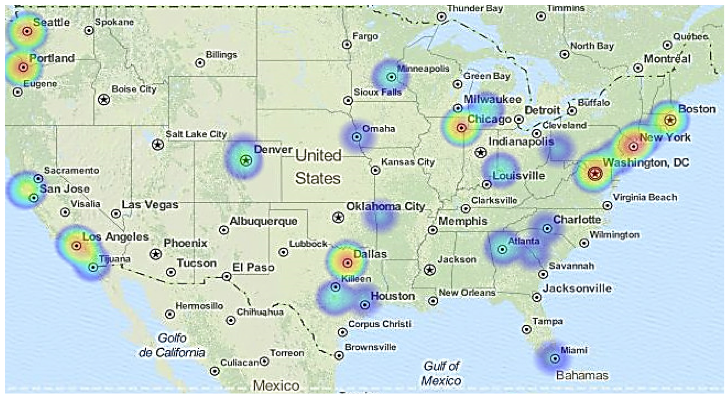

As of November 2012, there were 97 for-rent, market-rate residential properties (excluding special uses such as student and senior housing) in the U.S., seen in the following heat map.

The properties are predominantly situated in the coastal regions of the country, where many development trends begin, but are also now permeating the country's interior.

Our analysis compares these LEED-certified rental units to similar units that either did not pursue SEE features at all, or pursued such features but did not seek third-party certification through any SEE real estate program (LEED, Energy Star, etc.).

We find that LEED-certified apartment units earn approximately 9% more rent than the non-certified units.

This result is consistent with the large body of work examining the rental rate premium associated with LEED-certified office space.

Additionally, we find that SEE units that did not seek certification also earn a rent premium.

This indicates that people are willing to pay more for "green" features, whether a third party has certified their existence and quality or not.

This finding makes sense, as renters of such units should expect decreased utility bills, and will therefore be willing to pay more in rent for an energy-efficient apartment.

The result of particular importance comes from the simultaneous comparison of all three groups: LEED certified, SEE but non-certified, and non-SEE units.

We find that the rent premium for LEED certified units is double that of those that pursue SEE features but do not seek certification (9.1% versus 4.7%).

Having identified that the LEED signal does garner a sizable rental rate premium, we turn to an example to measure the impact.

We create a hypothetical building, based on the average characteristics of all buildings used in our analysis.

This building has 250 units with an average size of 1,000 square feet, and earns gross rent of $2.67 per square foot monthly.

Using a conservative rent premium of 4.5% (roughly the added benefit of pursuing LEED certification over just investing in SEE features), the LEED certified building would earn an extra $0.12 per square foot in gross rent, or approximately $200,000.

This $200,000 in added income is reoccurring annually.

Therefore, while LEED certification may be a costly signal, those costs should be easily offset by added rental income.

Additionally, this rent premium should not be associated with any added expenses (in fact, it should be associated with expense decreases, but those won't be considered in this example), so the added rent should translate directly to added net operating income, and can therefore be capitalized into added value.

Data from 2012 indicates a 6% capitalization rate provides a reasonable value estimate for the building, resulting in over $3 million in added property value on a building worth approximately $70-$80 million.

Therefore, for those interested in an effective way to invest their funds in a property to support greater return, LEED certification may be the answer.

The decision whether or not to seek third-party SEE certification is complex. The added cost associated with SEE certification can be high. However, our research indicates that the added benefit (rental rate premium) experienced by LEED-certified units is twice that experienced by those properties which incorporate SEE principles yet do not seek certification.

This indicates that the market values the LEED signal, and is willing to pay for third-party verification.

Additionally, the magnitude of the financial benefit is substantial, and sufficient to offset the costs associated with certification.

So, to all those questioning why they should seek certification, the answer is: because the market will pay for it.

A working version of this paper is available for free from SSRN at: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2499222

The published version is available from the Journal at: http://link.springer.com/article/10.1007/s11146-015-9499-y?sa_campaign=email/event/articleAuthor/onlineFirst