Dive Brief:

- Despite posting a loss of $3.89 billion in its fourth quarter earnings report, Airbnb officials say they will weather and rebound from the coronavirus as people live and work "nomadically" and seek flexible living arrangements.

- In the company's first earnings call since its initial public offering (IPO) in December, CEO Brian Chesky acknowledged 2020 was a "difficult year." Airbnb reported a Q4 revenue of $859 million, down a better-than-expected 22% compared to the same period in 2019. He said those figures showed Airbnb's "resilient business performance" amid the pandemic.

- The company declined to provide an outlook for the rest of 2021, both in the call and in a letter to shareholders released beforehand. But Chesky said on the earnings call that Airbnb is well-positioned for what he called the "coming travel rebound," and will look to recruit more hosts and provide "world-class service" to meet demand and improve the experience for guests and hosts alike.

Dive Insight:

City leaders have raised concerns about the future of their downtowns if large-scale remote work persists. But those leaders may be heartened by what Chesky said on the call about how people miss traveling more than any other activity outside the home.

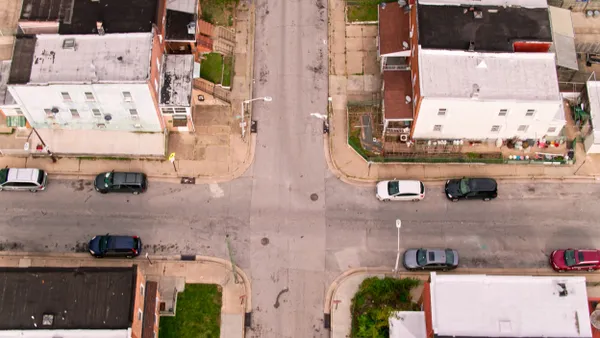

Domestic travel, especially to smaller communities, could also be popular, he said. In the immediate term, Chesky said people are widening their travel plans to try something new during the pandemic, which not only benefits Airbnb but also those smaller communities, many of which have seen budgets decimated by COVID-19.

"One of the things we're seeing is a change of travel patterns right now in the pandemic," Chesky said. "People aren't just looking to go to the same 20 cities or 30 cities. They now want to get in cars and travel to the local communities nearby. That means travel, in a sense, is being redistributed to thousands of communities."

In paperwork filed with the U.S. Securities and Exchange Commission (SEC) ahead of its IPO, Airbnb said the impacts of COVID-19 on its business depended on a slew of factors, including how long the pandemic persists, how long governments enforce travel restrictions and how quickly a vaccine can roll out.

And while Chesky and others said there is still much uncertainty about the timing and nature of worldwide recovery, they sounded a note of optimism about the future. In particular, he said the growth of remote work will help Airbnb keep revenues high.

"We don't think we're ever going back to the world of travel in 2019, it's going to change and it's going to be different," Chesky said. "And probably, the biggest difference we've seen is flexibility. A world of Zoom is a world where more people can work from home ... We're seeing more people say they can work from any home on Airbnb."

Some analysts are bullish on Airbnb's recovery from the pandemic, although others are more cautious. In a note after the call, Susquehanna International Group analysts said that while recovery in the travel sector will likely be "bumpy and slow," they see Airbnb as a "must-own name for the recovery." Analysts at Needham said they are also confident given how Airbnb has performed financially "through the teeth of the pandemic," while Jefferies analyst Brent Thill said the company is the "best COVID play in travel."