UPDATE, Dec. 10, 2020: Airbnb’s shares started trading Thursday in its Nasdaq debut, with its initial public offering priced at $146 a share — almost double the company’s initial share price of $68. The company is trading under the “ABNB” ticker.

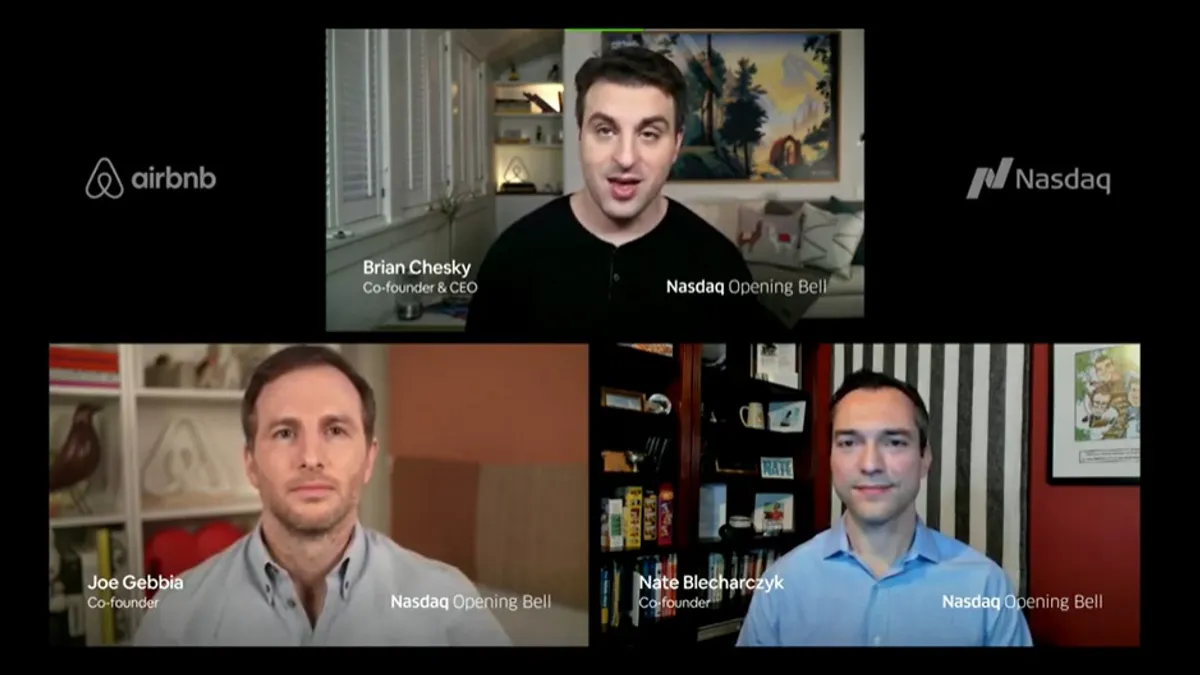

The share price meant the company debuted with a more-than $87 billion market value. The company’s co-founders Brian Chesky, Joe Gebbia and Nate Blecharczyk rang Nasdaq’s opening bell virtually from San Francisco to mark the occasion.

In an interview with CNBC ahead of the IPO, Chesky said with remote work now a way of life for millions of people due to the COVID-19 pandemic, the company is well placed to take advantage of such flexibility.

Nov. 17, 2020: After teasing an initial public offering (IPO) for many months, Airbnb gave investors a look at its operations and financials on Monday in its S-1 form filed with the Securities and Exchange Commission (SEC).

The filing comes after a difficult year for the short-term rental industry, as well as the rest of the hospitality and travel sectors, which have seen revenues decimated by the COVID-19 pandemic.

The company aims to raise $3 billion from its upcoming investor roadshow and hopes to be listed on Nasdaq by year's end, with an overall valuation of more than $30 billion. Bloomberg reported the company also is considering a dual listing on the Long-Term Stock Exchange, a trading platform for companies committed to environmental, social and corporate responsibility.

COVID-19 has clearly had a major impact on Airbnb as customer's travel habits have shifted amid concerns about rising infection rates. And while company officials acknowledge the pandemic will have a continued negative impact on business, they appear confident the company can come out stronger the other side of the crisis.

Airbnb is concerned about its long-term profitability, however, and argued that the shifting regulatory landscape could cause uncertainty, as cities, states and potentially the federal government look to craft laws governing this fast-growing industry.

Smart Cities Dive pulled out key insights from Airbnb's S-1, highlighting the potential implications for the future of short-term rentals in cities, during and after the pandemic.

COVID-19's impact and legacy

Airbnb's S-1 filing says its business "declined significantly" in the initial months of the pandemic. The company's Gross Booking Value (GBV) was at $18 billion over the first nine months of the year, down 39% year-over-year (YoY), while it generated revenue of $2.5 billion, down 32% YoY. To counteract the downturn, the company cut back on its operating costs, but said it is unclear how long difficulties from COVID-19 will last.

"In light of the evolving nature of COVID-19 and the uncertainty it has produced around the world, we do not believe it is possible to predict COVID-19's cumulative and ultimate impact on our future business, results of operations, and financial condition," Airbnb’s S-1 filing reads. "COVID-19 has materially adversely affected our recent operating and financial results and is continuing to materially adversely impact our long-term operating and financial results."

Airbnb said the pandemic, which is in the throes of another surge of cases across the U.S., may mean further cuts to operating costs. Given the wide-ranging impacts coronavirus has had on cities, it is difficult to know when things may return to normal for the company, even amid progress on developing and deploying an effective vaccine.

"The extent of the impact of the COVID-19 pandemic on our business and financial results will depend largely on future developments, including the duration and extent of the spread of COVID-19 both globally and within the United States, the prevalence of local, national, and international travel restrictions, significantly reduced flight volume, the impact on capital and financial markets and on the U.S. and global economies, foreign currencies exchange, and governmental or regulatory orders that impact our business, all of which are highly uncertain and cannot be predicted," the filing reads.

"Moreover, even after shelter-in-place orders and travel advisories are lifted, demand for our offerings, particularly those related to cross-border travel, may remain depressed for a significant length of time, and we cannot predict if and when demand will return to pre-COVID-19 levels," it continues.

But as recovery continues and cities try to regain some form of normalcy, Airbnb sounded a note of optimism when it said it will be a "vital source of economic empowerment for millions of people."

Profitability concerns

Last year's high-profile IPOs of ride-hailing giants Uber and Lyft raised significant questions about whether the companies can be profitable in the future — and Airbnb has similar concerns.

Airbnb said it incurred net losses of $70 million, $16.9 million, $674.3 million and $696.9 million in 2017, 2018, 2019 and the nine months that ended Sept. 30, 2020, respectively. The company had an accumulated deficit of $2.1 billion as of Sept. 30, 2020. And while it has been aggressive in raising capital from venture firms and investors since its founding in a bid to grow its user base and staffing, the company said painful cuts may have to be made as the impacts of COVID-19 continue to eat into revenue. Airbnb already cut about 1,800 employees in May.

The company said it expects a "significant net loss" from 2020 but has plans to continue to improve its offerings, albeit with the looming specter of those investments being higher than planned.

"[Overall], we expect to resume making significant investments in our business and our host and guest community, including improvements to our payments platform, trust and safety on our platform, technology, and infrastructure in the future," the S-1 filing reads. "These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenue sufficiently to offset these higher expenses."

Regulatory worries

City and state governments have attempted to regulate the short-term rental industry, blaming the trend for a shortage of affordable housing. New Orleans and Boston have been among those to pass local laws on short-term rentals, while San Diego repealed its local regulations in 2018 and has not yet replaced them.

Airbnb warned in its S-1 that new laws may limit the ability or willingness for people to be hosts on its platform, or may open up the company to fines and other penalties. It said the hotel industry will likely continue to lobby for stricter regulations on short-term rentals, while private entities like homeowners, landlords and condo boards are among those to have contracts or other bans on using platforms like Airbnb.

"New laws, regulations, government policies, or changes in their interpretations in the approximately 100,000 cities where we operate entail significant challenges and uncertainties," the S-1 reads. "In the event of any such changes, pre-existing bookings may not be honored and current and future listings and bookings could decline significantly, and our relationship with our hosts and guests could be negatively impacted, which would have a materially adverse effect on our business, results of operations, and financial condition."

New York is among the cities that have had a legal spat with Airbnb. The company sued the city in 2018 over its rules on short-term rentals and settled in June with an agreement to hand over host data to the city.

While the company has looked to build bridges with cities, including through a new data portal designed to give governments and tourism organizations more insight into Airbnb listings and community activity, Airbnb acknowledged it is likely to "become involved in disputes with government agencies," and pledged to use lawsuits to try and fight back. That could mean further rancor with cities, which could be forced into long taxpayer-funded legal fights with the company and could damage the relationship between city leaders and Airbnb.

"When a government agency seeks to apply laws and regulations in a manner that limits or curtails hosts’ or guests' ability or willingness to list and search for accommodations in that particular geography, we have attempted and may continue to attempt through litigation or other means to defend against such application of laws and regulations, but have sometimes been and may continue to be unsuccessful in certain of those efforts," the S-1 filing reads.

Short-term rentals in the long-term

Despite the challenges it faces, Airbnb projected an air of measured confidence about the future of the short-term rental market, albeit tempered by the expectation that the COVID-19 pandemic will continue to negatively impact business for some time.

One area where company officials are optimistic is in the growth of remote work and telecommuting trends. Airbnb said that trend, which has led to cities experimenting with incentive programs to encourage remote workers to relocate, could be beneficial for its balance sheet.

"Stays of longer than a few days started increasing as work-from-home became work-from-any-home on Airbnb," the S-1 reads. "We believe that the lines between travel and living are blurring, and the global pandemic has accelerated the ability to live anywhere. Our platform has proven adaptable to serve these new ways of traveling."

But the company is concerned that it needs to attract and retain new hosts, and it said many factors around hosting are out of its control as hosts are given a lot of autonomy in their listings. If, for example, hosts do not respond to guests in a timely fashion, Airbnb warned that could result in fewer bookings and less revenue.

Guests may also be less inclined to book with Airbnb if they have a negative experience, the company warned. Other factors like extreme weather, restrictions and changes in foreign and domestic policy could make customers less likely to book through the platform.

In a bid to grow, Airbnb said it intends to expand its guest community; invest in its brand; widen its global network into more cities and countries; innovate on its platform to improve the guest and hosting experience; and design new products. The company also plans to expand its host community, saying it has "just scratched the surface of the opportunities that hosting can provide."

Airbnb's ambitions have some experts excited as well. Scott Galloway, a professor of marketing at New York University's Stern School of Business, wrote last month that he believes this time next year Airbnb "will be the most valuable hospitality firm in the world and one of the world's 10 strongest brands" due to its global supply of places to stay and global demand of guests.