Dive Brief:

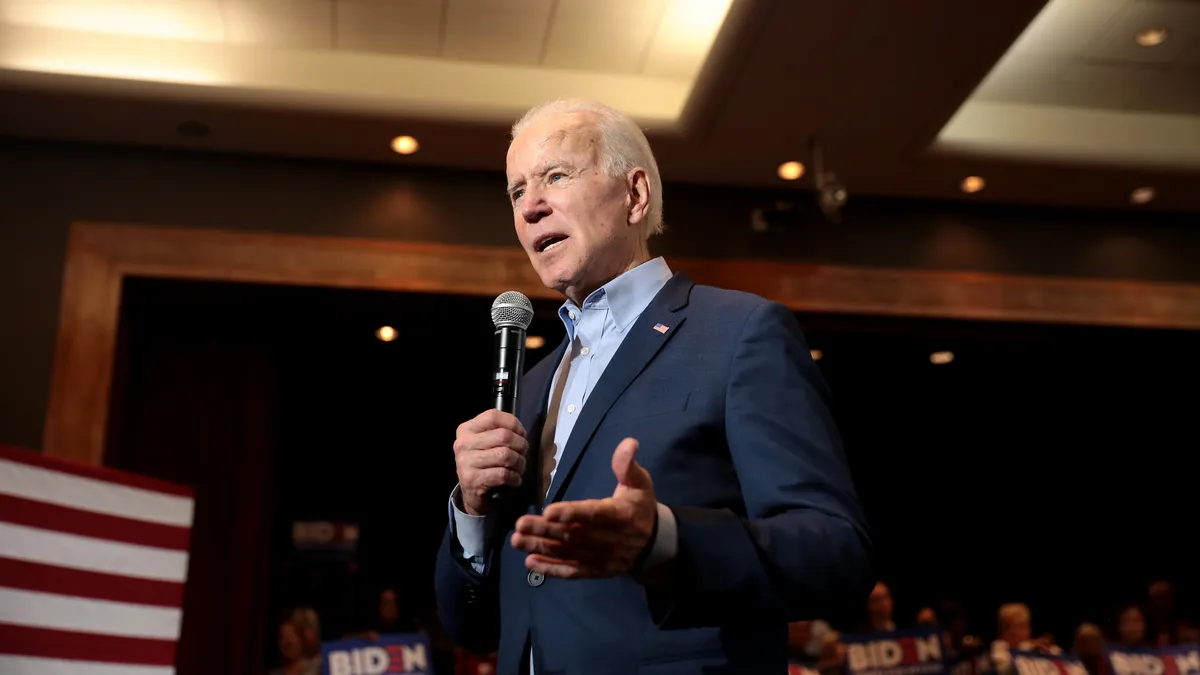

- In a Tuesday afternoon speech, presidential candidate Joe Biden outlined his plan for nearly $2 trillion in infrastructure spending focused mostly on renewable energy and electrification, which he described as a "one-time" opportunity to reestablish the U.S. as a global economic and political leader.

- Sweeping investments would spur millions of jobs and the construction of energy-efficient public housing, installation of 500,000 electric vehicle (EV) charging stations, and would end carbon-based electrical generation by 2035, Biden said.

- Earlier that day, the American Council on Renewable Energy (ACORE) released its third-annual survey of investor attitudes toward renewable energy, which reflected similar sentiments about opportunity and resiliency in the renewable energy sector.

Dive Insight:

Climate change isn't the next problem awaiting Americans when the nation emerges from the COVID-19 pandemic — it's an opportunity to accelerate economic recovery, Biden said Tuesday.

"We need to modernize America's infrastructure," Biden said, criticizing President Donald Trump's "broken promises" of major infrastructure spending. "Here we are with an economy in crisis, but an incredible opportunity to not just build back to where we were before, but better, stronger, and more resilient."

Biden described climate change as an "existential threat" to the survival of humanity, but also as an economic opportunity. "When I think about climate change, the word I think of is 'jobs,'" he said. "Good paying, union jobs to put Americans to work."

In his first four years in office, Biden said, he would reinstate environmental and public health regulations blocked by the Trump administration, and then immediately set about investing public funds in renewable energy and other sustainable infrastructure initiatives. Government-owned vehicle fleets would be electrified, and rebates made available to help citizens trade in gasoline-powered cars. Biden also envisioned a nationwide network of 500,000 EV charging stations, initiatives he predicted would create 1 million new jobs in the U.S. automotive industry.

Biden also spoke of launching an environmental justice initiative to repair environmental and economic harms to "fenceline" communities populated primarily by minorities, saying that more than a quarter million jobs are needed just to plug abandoned oil and gas wells and address other environmental hazards that pollute disadvantaged communities across the country.

He also said he would build 1.5 million new, energy efficient homes to address emissions, and the affordable housing crisis. Another 4 million buildings would be retrofitted, spurring the creation of another 1 million jobs, he said, and electrical generation would be decarbonized to ensure these electrified homes run on clean energy.

"Donald Trump thinks windmills somehow cause cancer," Biden said. "When I think about these windmills, I think about American manufacturing. I see the steel that will be needed, that can be made by small manufacturers."

To accomplish these goals, he said, would require funding national laboratories and universities to develop the storage and transmission technologies necessary to enable the U.S.'s clean energy transformation.

His comments mirror the findings of the ACORE survey, also released on Tuesday, which found that investors ranked energy storage as the most desirable sector to invest in, despite the reality that energy storage still secures a minority of the overall investment dollars dedicated to renewable energy. An increase in government incentives for storage projects, according to ACORE, could change this trend.

The renewable sector was coming off a record-breaking year when COVID-19 hit, with private investment in U.S. renewable energy projects increasing to $58.4 billion, a 21% increase over 2018.

Investors and developers who responded to the ACORE survey reported a belief that overall investment could decline slightly in 2020 due to COVID-19. However, the respondents mostly reported they planned to increase their own investment in 2020, seemingly contradicting their predictions for overall 2020 markets.

Panelists speaking during a Tuesday morning ACORE webinar indicated that the predicted decline in investment activity did not reflect their on-the-ground experience, while financiers on the panel reported they are on track to close a glut of deals by the end of the year.

But ACORE also reported that the U.S. has some ground to make up if it hopes to reach the council's goal of $1 trillion invested in renewable energy by 2030. The U.S. is about one-eighth of the way toward accomplishing this goal; to catch up will require an average annual investment of $87.5 billion, or an annual increase of 28% per year. Whether this growth is attainable will hinge on improvements in storage and transmission, according to ACORE.