Dive Brief:

- Low-income District of Columbia residents who received $5,500 in direct cash payments in a program that four community-based nonprofits operated reported improved mental health and lower food insecurity compared with other low-income individuals locally and nationally, a new report from the Urban Institute found.

- The THRIVE East of the River program distributed the money either as a lump sum or in five monthly installments between July 2020 and January 2022 to 590 residents living in neighborhoods that faced disproportionately negative economic impacts during the COVID-19 pandemic, the report stated.

- The report's findings underscore how assistance programs that distribute cash payments without restrictions or barriers to accessing the support can help stabilize families in crisis and suggest that such relief could effectively close disparities and advance economic mobility, said Mary Bogle, a principal research associate at the Urban Institute and the report's lead author.

Dive Insight:

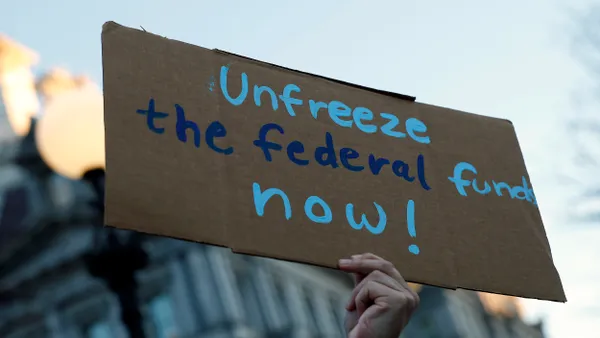

Diverging from government assistance programs that often have strict requirements or confusing application processes, a growing number of cities and government leaders have embraced policies that provide cash support to families with no strings attached.

Last year, the U.S. childhood poverty rate dropped nearly 30% after the American Rescue Plan expanded the federal child tax credit, distributing monthly payments to millions of families with children. Since the expanded credit expired at the start of 2022, the childhood poverty rate has increased substantially.

At the local level, mayors from more than 60 U.S. cities, including Atlanta, Los Angeles, Seattle, New Orleans, Philadelphia, Pittsburgh and Saint Paul, Minnesota, have joined a coalition advocating for direct cash payment policies that provide a guaranteed basic income.

Several cities have launched or are in the process of launching pilots of cash payment programs. Chicago plans to distribute $500 monthly payments to 5,000 participants facing economic hardship. Atlanta is partnering with the Urban League of Greater Atlanta to distribute $500 monthly payments to 300 residents in a 12-month pilot. And Shreveport, Louisiana, recently began accepting applications for its $660-per-month guaranteed income program, which will serve 110 single-parent, low-income families.

Unlike those programs, the D.C. effort was funded and operated privately by the four community-based organizations, which raised more than $4 million in donations, said Bogle.

More than half of the recipients reported using a substantial amount of their payment on housing. Like many cities, D.C. is facing a housing crisis, with a shortage of affordable housing and increased homelessness. Food was the second-most-common spending category. About 40% of the recipients reported using at least a little bit of the funds to make progress on paying down debts.

In addition to receiving the $5,500 cash payment, program recipients were offered weekly groceries, monthly household goods such as food storage containers and towels, as well as assistance securing other resources, such as pandemic stimulus payments, unemployment insurance, mental health support and workforce training, the report stated. A large number of participants opted not to take the program's groceries due to difficulties in picking them up. Still, the proportion of participants who reported they sometimes or often did not have enough to eat fell from 34% to 19% after they received the cash payments.

The number of participants who reportedly reached into their personal savings to meet household needs decreased from 60% to 50% after receiving the payments, the report stated. The number of people who borrowed from friends or family also decreased slightly after receiving the funds, while the number of people who relied on credit cards or loans increased slightly.

Fewer recipients also reported not having enough to eat and being worried about their children's emotional states after receiving the payments than before. Of the small business owners that received the cash support, 71% said it helped them "to invest in their businesses in ways that helped them weather threats against their livelihood," the report found.

Bogle said the program resulted in better mental health outcomes for recipients because it trusted their spending choices, providing dignity and respect in a way that other social safety net programs don't. Existing programs are based on the assumption that people who receive the benefits are going to spend their money on temptation goods, Bogle said, when in reality, low-income people don't spend their money on temptation goods any more than the general U.S. population does. She characterized the requirements governments put in place for residents to obtain benefits as "structural racism."

"People in poverty, the people who have low income, often experience much higher rates of stress than the average person because of things like not being able to pay the rent, not being able to make ends meet," Bogle said.

Direct cash payments are more efficient than in-kind benefits or those that restrict recipients to using the money on one thing, like food or housing, since it allows them to spend it on what they need versus a "one-size-fits-all approach," said Angela Rachidi, a senior fellow at the American Enterprise Institute.

But there are trade-offs, especially when it comes to government-funded programs, said Rachidi. Since you're dealing with taxpayer funds, you want to ensure that people are using the money in the way it was intended, she said, and the benefits could disincentivize people from seeking employment.

"In general, I think the direct cash programs can really be more beneficial, but there’s always the concern about employment,” she said.

Bogle says, however, that the current social safety net actually hinders upward mobility in many cases. A lot of people receive public benefits and work low-wage jobs, she said. They sometimes make rational decisions not to work higher-income jobs because once they do, they will start losing benefits and go over a financial cliff where their income suddenly falls below their expenses, she said.

Rachidi agreed that guaranteed income programs, or rolling back means-testing requirements that are part of other existing programs, could alleviate that issue, but such proposals would also become very costly.

The idea of guaranteed income was once championed by Martin Luther King Jr. and, in recent years, popularized by former Democratic presidential candidate and New York City mayoral candidate Andrew Yang. Others, including New York City Mayor Eric Adams, have criticized such policies.

The "findings from THRIVE have much to contribute to the growing body of research on guaranteed income," the report stated. The program provided "measurable short-term relief" to its participants, it stated. "One of the things we saw with THRIVE very clearly is that people made these really thoughtful, dynamic choices," said Bogle. "But it involves trusting people to make good decisions, and our safety net is designed with a lack of trust."