Dive Brief:

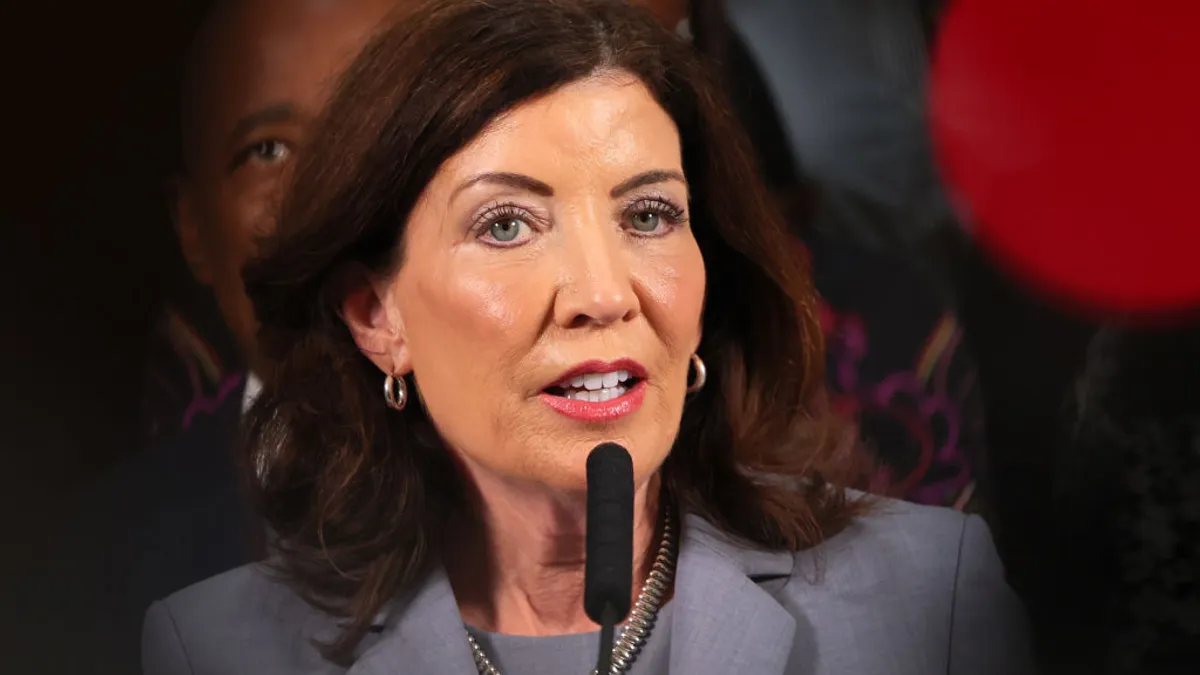

- New York Gov. Kathy Hochul outlined several proposals to address the state’s affordable housing shortage in a Thursday press release.

- Hochul’s proposals aim to prevent hedge funds and private equity firms from buying up one- and two-family homes, boost the construction of “starter homes” and lower certain financial barriers for home buyers.

- “The cost of living is just too damn high — especially when it comes to the sky-high rents and mortgages New Yorkers pay every month,” Hochul said in a statement.

Dive Insight:

New York consistently ranks among the states with the highest housing cost burdens for both renters and homeowners, according to a February 2024 report from the New York State Comptroller. Meanwhile, New York City is facing its tightest housing market in half a century, with a rental vacancy rate of just 1.4%, according to city data also released in February 2024.

One of the factors contributing to the state’s affordable housing shortage is the increasingly significant role institutional investors are playing in the housing market for single-family and two-family homes, Hochul said. “These large entities can often outbid prospective homeowners with all cash offers and fast track their ownership by waiving inspections, appraisals and other common prerequisites that traditional homebuyers cannot,” Hochul’s press release said.

The governor is proposing legislation that would require a 75-day waiting period for institutional investors to make offers on one- and two-family homes. She also wants to prohibit institutional investors from taking advantage of certain tax code provisions that make their investment in these types of homes more lucrative. Hochul said that if the state legislature approves these proposals, the result would be a nation-leading model for disincentivizing institutional investors from buying up homes.

Cities nationwide are attempting to combat this challenge. Last year, for example, Newark, New Jersey, launched a program allowing residents to purchase city-owned properties for $1, to help prevent corporate investors from buying homes and hiking up the rent. A program in Boston helps “mission-driven” developers purchase homes that go up for sale to protect those properties from private investors who might flip them for a profit.

Another contributor to New York’s housing affordability crisis is that many homes built today are larger and less affordable than traditional starter homes, according to Hochul. She is proposing $50 million in funding to bolster the construction of more starter homes.

Hochul also wants to reduce financial barriers to homeownership, such as down payments and local property taxes. She is proposing $50 million in new state funding to help New Yorkers with down payments as well as a property tax incentive for certain affordable homes.

Hochul is also advocating for policies to address discrimination in the home appraisal process, which she said can strip families of the opportunity to build generational wealth and widen racial wealth gaps.