The nation’s most populous metropolitan area faces potential electricity shortfalls in 2033 and 2034, driven by electrification and large commercial projects including data centers, the New York Independent System Operator said Thursday.

After accounting for expected economic growth and policy-driven demand increases, including ambitious environmental and energy policies and evolving market rules, the grid operator’s 2024 Reliability Needs Assessment identified a 17 MW shortfall in summer 2033 for New York City, increasing to 97 MW in summer 2034. And reliability margins could be deficient as soon as 2026, if the Champlain Hudson Power Express transmission project is not brought online by May of that year, the ISO said. The transmission line will bring power to New York City from Québec.

Along with growth in electric vehicles and building electrification, the shortfall is driven by state legislation passed last year that requires the New York Power Authority to deactivate small gas-fired plants located in the city and Long Island. The retirements would result in a loss of 517 MW, though the ISO noted that the new law authorizes NYPA to confer with the state’s grid operator to determine if the plants are necessary for reliability.

While other areas of the state meet reliability requirements, the ISO’s report noted “a declining statewide system margin due to increased demand, anticipated generation retirements without adequate new generation addition, and the unavailability of non-firm gas during winter peak conditions.”

“Our latest report demonstrates the continued importance of the NYISO’s in-depth planning process and the need to closely monitor the rapidly changing electric grid,” Zach Smith, the grid operator’s senior vice president of system and resource planning, said in a statement.

NYISO said it will seek system updates that can help to reduce or eliminate the reliability needs, and will request updates on the status of proposed projects, such as those planned by local transmission owners or proposed generation and transmission additions, that can help address the need.

Because the need occurs in Consolidated Edison’s transmission district, the ISO said that if sufficient market-based solutions can not be put in place before the shortfall then the utility will be required to submit a regulated backstop solution to address the need.

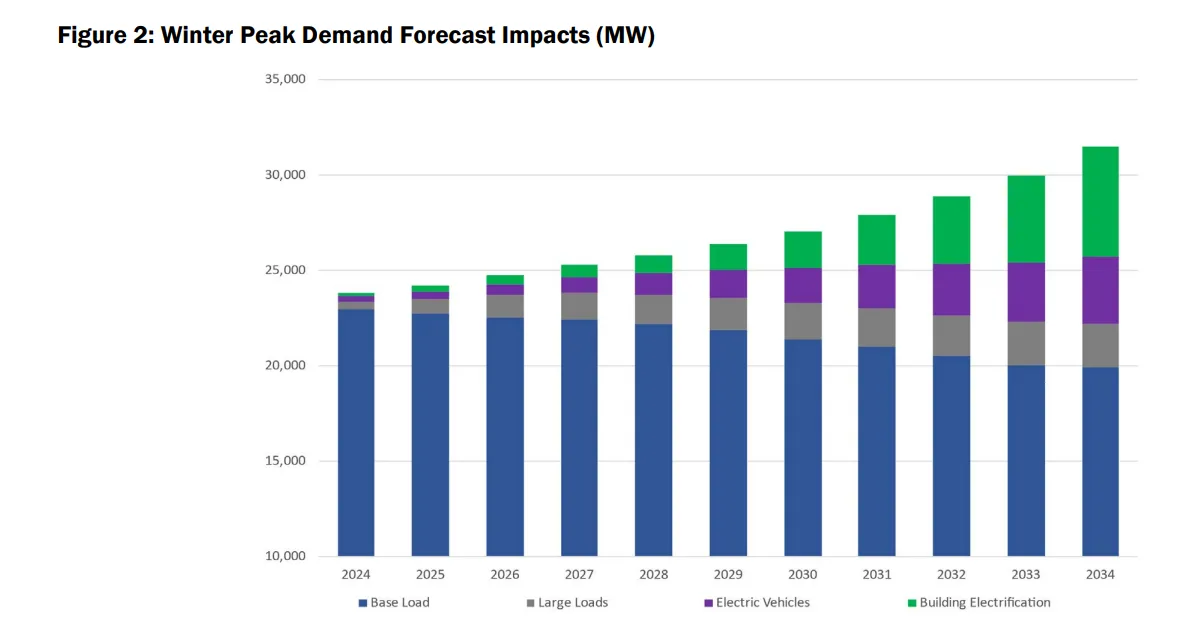

New York’s peak system demand is forecast to grow by a total of approximately 7,300 MW in winter and 2,300 MW in summer over the next ten years, which the ISO said is driving the reliability need and risks identified in the assessment.

Load growth projections “are tightly tied to specific state policies contributing to the electrification of building conditioning and transportation, as well as the increases in the interconnection of discrete large loads,” the ISO said in its report.

“As the New York statewide grid is expected to become winter peaking in the mid-2030s, it is expected that the gas supply to electric generation plants will be strained beyond what has been observed historically,” the ISO added.

The projected violation of reliability criteria identified in the report is the second potential shortfall the New York ISO has identified recently.

In July, the ISO concluded New York City will face a 446 MW deficit in its reliability margin beginning in the summer of 2025 due to rising demand and new emission limits on peaker plants. To address the situation, the grid operator opted to keep four peaker plants operating past their expected May 2025 retirement date in order to maintain reliability.