Dive Brief:

- New York State Comptroller Thomas DiNapoli said that the New York Metropolitan Transportation Authority “must find billions in new funds” to cover the loss of congestion pricing revenue and to pay for its next five-year capital investment program, in a Sept. 12 report.

- Referencing an earlier comptroller’s report, DiNapoli said the MTA has “an overwhelming list of capital needs,” the most critical of which are just to keep the agency’s system in a state of good repair.

- New York Gov. Kathy Hochul’s decision to halt the congestion pricing program created a $15 billion gap in the MTA’s funding for its current 2020 to 2024 capital investment plan. But the agency’s finance leaders have said the impact could be up to $16.5 billion in delayed projects with an additional cost of $800 million to its operating budget as deferred procurement of new trains and buses would mean higher maintenance costs for older equipment.

Dive Insight:

An Oct. 1 deadline is looming for the MTA to submit its 2025 to 2029 capital investment plan to the state even as the agency faces uncertainty about its future funding and revenue stream. The MTA is required to explain its choices and the impact to riders of cancellation or delays in capital investments.

The comptroller’s report outlined some of the most critical funding needs:

- Up to $16.5 billion to replace aging subway cars and commuter rail cars that will reach the end of their useful life between 2024 and 2030.

- As much as $4.5 billion to purchase transit buses, depending on choices for the fleet.

- From $5.3 billion to $8.1 billion to satisfy a court agreement requiring the MTA to make subways more accessible and meet the requirements of the Americans with Disabilities Act. Of the system’s 472 stations, at least 150 are currently accessible according to the MTA.

- A minimum of $6 billion over 10 years to protect the transportation system from the effects of climate change-driven increases in severe weather.

- From $37.3 billion to more than $55 billion for normal replacement and state-of-good-repair projects.

The MTA’s options are constrained by its ability to pay the debt on bonds that it issues. Currently, debt repayment eats up 15% of the agency’s operating budget. The MTA could double the planned 4% fare increase scheduled for next year but at a potential loss of ridership, DiNapoli said in a press release.

The comptroller’s analysis assumes a continuation of typical state and New York City contributions to the MTA’s capital program, but Hochul has only suggested an increase in the payroll tax on New York businesses to replace congestion pricing revenue. The state legislature ended this year’s session without acting on the proposal.

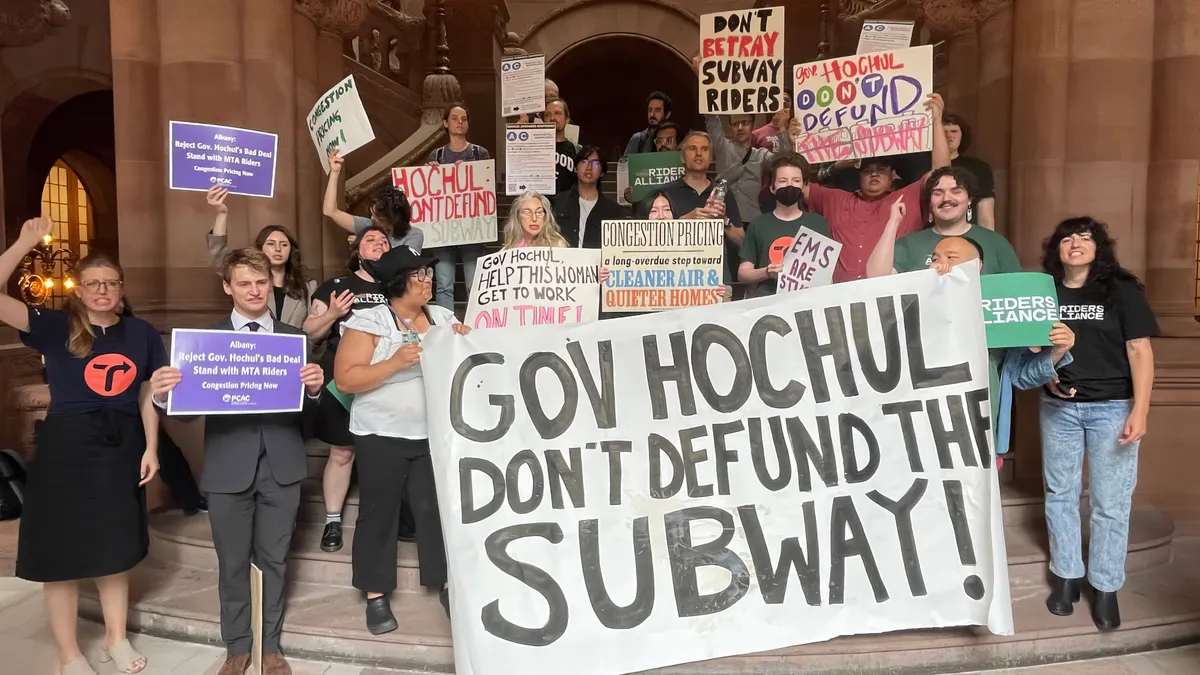

The governor faces two lawsuits from advocates of the congestion pricing program. Some believe that Hochul’s order was driven by election politics and that she may revive the program following the November elections, perhaps with lower tolls on vehicles entering Manhattan at or below 60th Street.

Absent projected revenues from the congestion pricing program, the comptroller estimates total unfunded capital projects from the current and next capital programs could exceed $100 billion.