Dive Brief:

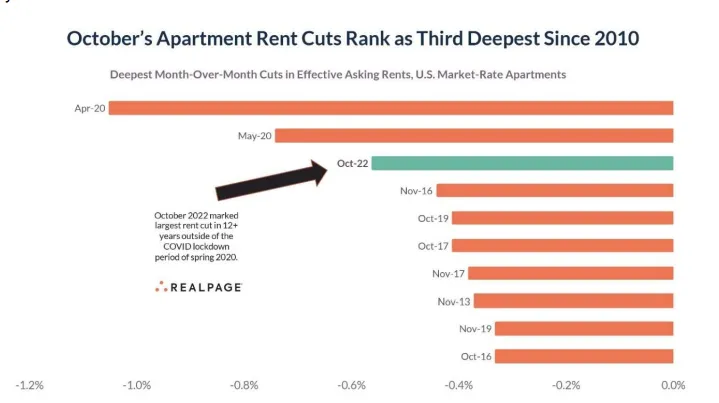

- U.S. rents fell by 0.6% in October, according to RealPage’s latest rent report. This marks the second month in a row of rent decreases, as well as the third largest monthly rent cut recorded by the software and analytics firm since 2010, only surpassed by the COVID-19 lockdown period in April and May 2020.

- Out of the nation’s 150 largest markets, 110 reported rent decreases in October, compared to 19 out of 150 markets one year earlier.

- On a year-over-year basis, effective asking rents rose 7.6% in October. This is the first time since early 2021 that asking rent growth has fallen short of headline inflation rates, according to RealPage.

Dive Insight:

While seasonal rent cuts are common in September and October, 2022’s drop is surprising for two reasons, according to Jay Parsons, vice president, head of economics and industry principals at RealPage. They are:

- The COVID-19 pandemic has disrupted regular seasonal rent patterns for the past two years. Rents rose significantly in every month in 2021, and so 2022 appears to mark a return to regular patterns.

- October’s 0.6% drop is the largest out of any October in 12 years, as well as the third largest out of any month in that period.

RealPage attributes these rent drops to weak demand and household formation slowing to a halt, Parsons said in the report. Still, vacancies remain relatively low at 4.7%, up slightly from the lowest level on record at the beginning of the year.

“The rental market of 2022 looks nothing like 2021. With Q3 almost in the books, the preliminary numbers for U.S. apartment demand look wayyyyyy weaker than expected,” said Parsons in a LinkedIn post on the October data. “This could be the downside scenario we warned about earlier this summer: Inflation, rising rates and plummeting consumer confidence appear to be having a freezing effect on demand for all types of housing. People are waiting it out. Not just the for-sale market, but rentals too.

Boise, Idaho, saw the steepest drop in rents on a month-to-month basis in October at 1.8%, following strong rent growth throughout the pandemic. Large markets with similarly sized cuts include Austin, Texas, at 1.4% and San Jose, California, at 1.3%. A number of Sun Belt and coastal markets have also seen rents fall about 1%, including Phoenix; San Francisco; and Raleigh, North Carolina.

Only three markets out of the top 50 reported rent gains month-over-month: Virginia Beach, Virginia (0.2%), Cincinnati (0.2%) and Newark, New Jersey (0.1%).

“[The] key now is to watch jobs and wages and consumer debt. If those numbers hold up as they have, we should see demand come back in strong numbers in spring 2023,” Parsons said.

“Remember we're now entering the seasonally slow leasing period of Q4/Q1. Demand and rents are usually negative in the winter, so that won't mean much if it happens again unless the dropoff is drastic.”