Dive Brief:

- As the trend toward remote work continues, the demand for office space has cooled off across the country — and multifamily developers have stepped in to create new uses for these and other existing structures.

- Apartment conversions have risen 25% in the two years since the start of the COVID-19 pandemic, with 28,000 new units on the market converted from other property types, according to a report from RentCafe. New apartment volume rose only 10% over the same period.

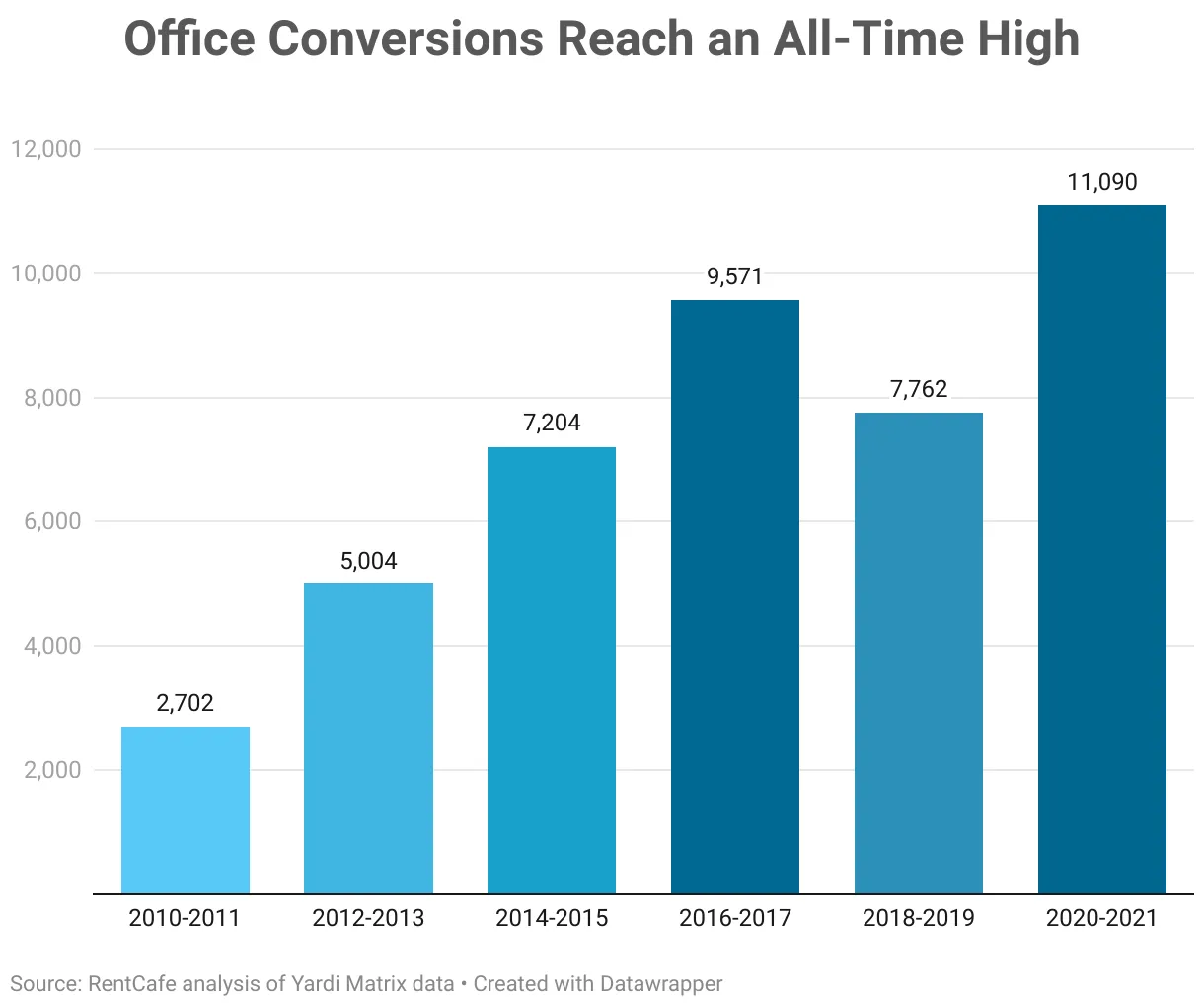

- Of that number, 11,090 new units are the product of office-to-apartment conversions, which have risen over 40% between 2020 and 2021 — an all-time high, according to RentCafe. Another 77,000 adaptive reuse units are currently being converted.

Dive Insight:

Washington, D.C., has seen the most apartment conversions over this period, with 1,565 new adaptive reuse units in 2020 and 2021 — over double the deliveries between 2018 and 2019. Overall, Washington, D.C. has 5.6% of the nation’s total adaptive reuse projects.

Seven existing properties in Washington were converted into multifamily housing in 2020 and 2021, according to Michelle Cretu, communications specialist for RentCafe. These projects, according to local radio station WTOP, include:

- Boathouse, a former Howard Johnson hotel located next door to the Watergate Hotel, converted into 250 apartments.

- The Wray, a former State Department building, converted into 158 units.

- Watermark, a former General Services Administration building, converted into 450 units.

- The Parks at Walter Reed, a master-planned community converted from the Walter Reed Army Medical Center, with 168 multifamily units delivered so far and 2,200 units, including condos and townhomes, expected at full buildout.

Conversions in Washington, Philadelphia and Chicago made up 15% of all adaptive reuse projects nationwide between 2020 and 2021. Philadelphia gained 1,552 converted units during this period, while Chicago converted older buildings into 1,139 new apartments.

Office buildings are by far the most popular for conversion, which RentCafe attributes to the rise of hybrid and remote work, as well as a desire among developers to construct “live-work-play” properties in place of whole office buildings.

“Existing building architecture is the critical starting point. Not all buildings are equally threatened by the work-from-home revolution,” said Doug Ressler, manager of business intelligence at Yardi Matrix, RentCafe’s parent company, in the report. “Larger office buildings in abandoned central business districts are better suited to conversion than the often-smaller office complexes distributed around the suburbs.”

Out of the 77,000 units in the conversion pipeline across the country, RentCafe projects that office conversions represent 28% of projects. Hotels have the second largest share at 22%, followed by factories at 16%.

Conversion activity hasn’t slowed at all in 2022; as of July, 8,300 new adaptive reuse units have been completed and opened for move-ins this year. Los Angeles is leading the nation in adaptive reuse construction for the first half of 2022 with 1,242 new deliveries — already the best year for adaptive reuse in the city’s history — and another 4,130 units in the construction pipeline.