Dive Brief:

- Utilities could save around $20 billion over the next two decades in gas pipeline replacement costs by electrifying groups of buildings where technically feasible in California rather than replacing the aging gas pipelines that serve those buildings, finds a new analysis prepared for the Natural Resources Defense Council by consultancy Energy and Environmental Economics.

- Those savings could be accomplished while only affecting about 3% of current gas customers, says the report published Thursday. Regulators could help realize these savings by allowing utilities to pursue such projects without requiring all customers to opt in.

- While electrification is more cost-effective than gas pipeline replacement in many cases, the analysis found that technical feasibility is still the main limitation for many potential projects, said Kiki Velez, equitable gas transition advocate for NRDC.

Dive Insight:

Some states, cities and utilities have begun to act on ambitious plans to prune back the gas pipeline system, with hopes to transition buildings onto clean energy.

Massachusetts established a first-of-its-kind state office in March charged with navigating the process. Earlier this month, the state also became home to the country’s first utility-owned networked geothermal system, which will pilot using ground-source heat pumps to heat and cool 36 buildings without fossil fuels.

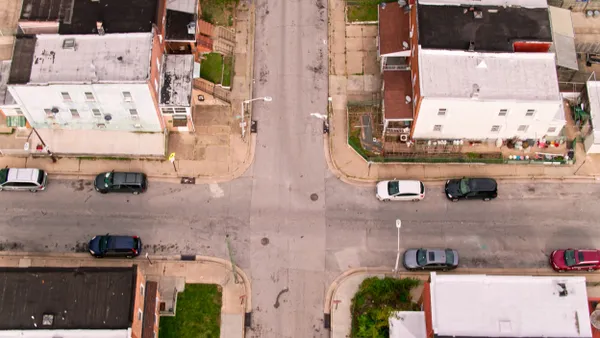

The small city of Albany, California, is looking into electrifying an entire city block and decommissioning the gas pipeline that serves the area. California utility PG&E has also done about 100 projects to electrify buildings rather than repair gas lines — although each of those projects has only impacted a couple customers at a time. Part of the challenge of doing larger projects is utilities’ “obligation to serve,” which has largely been interpreted to mean that utilities must provide gas service to anyone who asks for it — although experts have questioned whether it could mean utilities can provide similar service with other types of energy.

Some California lawmakers want to give targeted electrification efforts a leg up. A bill introduced this legislative session, SB 1221, would allow the state’s gas utilities to set up 30 projects to electrify neighborhoods rather than upgrading or replacing their gas pipes, as long as 67% of affected customers consent.

California’s legislative push motivated NRDC to show lawmakers and the public how much savings targeted electrification projects can realize, Velez said. “We just want to set up a framework to go for the low-hanging fruit,” she said. “If it's cost-effective, and it's feasible to do it, that should be the no-brainer option.”

Gas pipeline replacement costs about $3 million per mile, according to the E3 analysis prepared for the NRDC. The report highlights a frequent concern that people on the hook for paying that investment off will be lower-income homeowners and renters, who may have the hardest time electrifying.

SB 1221 would require utilities to file maps with the state showing both where they are considering replacing gas lines and locations of disadvantaged communities. Local governments can use such maps to see where potential targeted electrification projects could be in their jurisdiction, Velez said. “They can work with the utility to try to get that project to happen and try to engage local communities,” she said.

Velez said that SB 1221 is too limiting by only allowing for 30 projects; her team thinks it should be tied to decommissioning a certain percentage of the gas system, “like 1% through 2030, or something like that.”

A big remaining question for NRDC is how to pay for these projects over time, Velez said. Utilities are unlikely to invest in initial targeted electrification projects without some return on investment, like they can get with gas infrastructure projects, she said. In the longer run, Velez said NRDC would want California’s Public Utilities Commission to decide what appropriate cost recovery for targeted electrification projects should look like.

“I think it needs to be flexible because this is pretty new territory,” she said. “We haven't seen any utility really do these projects at scale anywhere in the country.”