Correction: A previous version of this story inaccurately stated the election results in multiple cities in Northern California. We have updated it to reflect the most current results.

Voters throughout the U.S. cast their ballots for or against proposals that could directly shape affordable housing in their communities. The measures included providing new funding for the construction or purchase of housing and additional protections for renters. While not every measure passed, many did, collectively unlocking billions of dollars for new housing nationwide.

Here’s what we know as of the evening of November 16:

Colorado voters approved Proposition 123, which requires the state government to set aside about 2% of income tax revenues in the annual budget for affordable housing, with 53% of the vote in favor as of Nov. 16.

A so-called ‘mansion tax' in Los Angeles appeared likely to pass with nearly 56% of the vote in favor as of Nov. 16. The measure imposes a one-time tax on residential and commercial property sales that exceed $5 million. Proceeds would go toward the construction of affordable housing, emergency rent subsidies and services for people who are at risk of becoming homeless.

Affordable housing was prevalent on many ballots throughout the Bay Area.

In Berkeley, California, two bond measures intended to address the affordable housing crisis in the city were on the ballot. As of Nov. 16, a $650 million bond measure, which sets aside $200 million to create 1,500 affordable units for low-income residents and people experiencing homelessness, has received 57% of the vote in support, which is short of the two-thirds, or near 67% threshold, needed to pass.

Another measure in Berkeley would force many property owners to pay between $3,000 and $6,000 if their homes or apartments sit vacant for at least six months during the first year of the tax. The amount doubles in year two of the tax. As of Nov. 16, it led with 62% of the vote in favor, above the simple majority needed to win.

San Francisco’s ‘empty homes tax,’ which places a $2,500 to $5,000 tax on the owners of residential units in buildings with three or more apartments that have been vacant for more than 182 days throughout the year, passed with 54% of the vote in favor as of Nov. 16.

However, as of Nov. 16, a similar measure in Santa Cruz, California, was on track to fail. It would have taxed homes that are unoccupied for at least 120 days throughout the year to raise money for new affordable housing projects. About six in 10 voters voted ‘no’ on the proposal.

In Oakland, California, a bond measure that sets aside $350 million to buy, rehabilitate and build affordable housing was on track to pass with 73% of voters supporting it as of Nov. 16.

Several measures by other cities and counties throughout the U.S. also had bond measures on the ballot intended to raise money for affordable housing and homelessness.

A bond measure in Buncombe County, North Carolina, (which is anchored by the city of Asheville) that raises $40 million to pay for low-to-moderate-income affordable housing passed with 62% of the vote in favor.

Charlotte, North Carolina, passed a $226 million bond package that provides $50 million to help bolster the city’s housing trust fund that provides financing for the developers of affordable housing projects, with 74% of the vote in support, according to Spectrum News.

Austin, Texas, passed a $350 million bond measure that creates low-income rental housing, supports low-income homeownership, pays for home repairs and preserves existing affordable housing, with 71% of the vote in favor, according to the Austin Statesman.

A $200 million bond package in Columbus, Ohio, that creates new affordable units, aids affordable home ownership, preserves existing affordable units and supports residents experiencing homelessness, passed with 68% of the vote in support.

Palm Beach County, Florida, passed a $200 million bond measure that pays for building and buying housing for households earning up to 140% of the area median income, with 55% of the vote in favor.

A measure in Kansas City, Missouri, that issues $50 million in general obligation bonds to rehabilitate, renovate and construct affordable housing for very low- to moderate-income households, passed with 71% of the vote in favor.

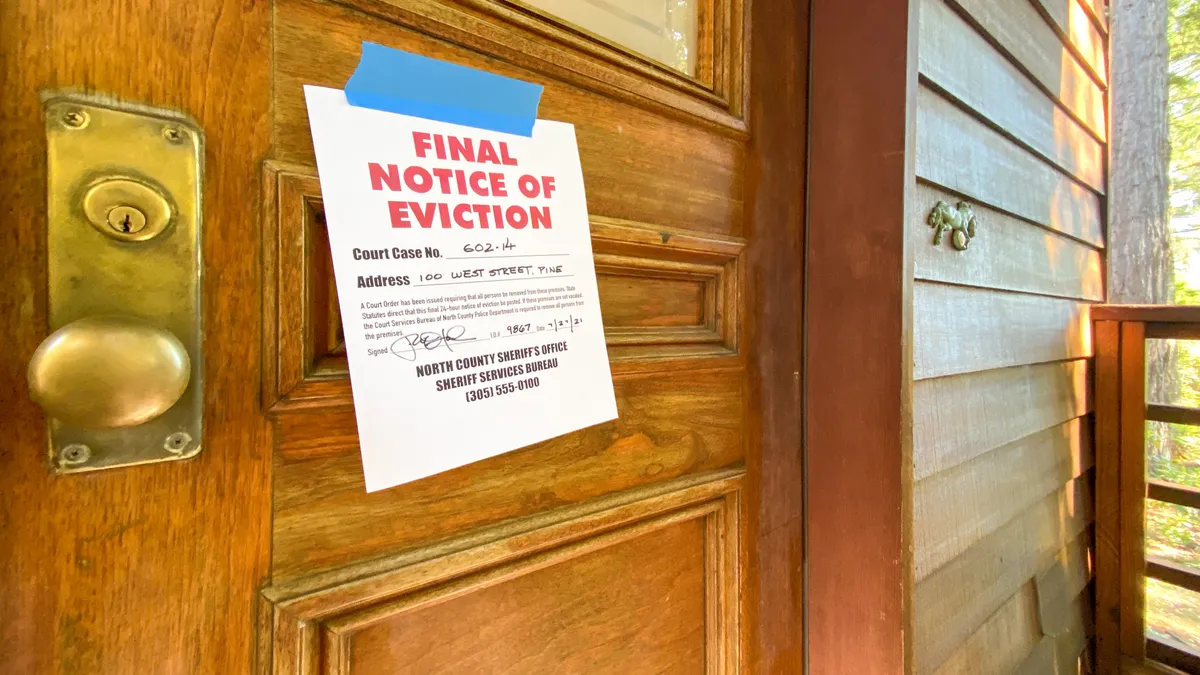

A ballot measure in Denver that would have imposed a $75 per rental unit annual excise tax to fund free legal services for those facing evictions, failed with 60% of vote against it.

As of Nov. 16, rent control measures in Los Angeles County were leading. A measure in Santa Monica, California, which would reduce the maximum amount a landlord is allowed to raise the rent of a rent-controlled unit each year from 6% to 3%, was leading with 57% in favor. Meanwhile, a measure in Pasadena, California, that would cap landlords’ ability to raise rents and require them to provide “just cause” to evict tenants, appears to have passed with 52% supporting it.

Portland, Maine passed a measure that further restricts the amount a landlord can raise the rent each year and requires landlords to give renters more notice for rate increases and lease termination, with 55% of the vote supporting it, according to WGME. The latest ballot initiative builds on another rent control measure the city passed in 2020.